R

eleased ahead of the economic statement by new chancellor Kwasi Kwarteng, we recently shared the results of a snap survey of members’ views on the current economic situation. As we head into autumn, the macro-economic picture is, frankly, poor with growing energy prices fuelling high levels of inflation.

The political world is only now returning to normality following a lengthy Conservative leadership contest, and a further delay owing to the Queen’s passing. Businesses have been patient in waiting for action from our Government, the economic statement on Friday (23 September) will be the first real opportunity in months for a suite of meaningful measures to be introduced and debated.

As ACE CEO Stephen Marcos Jones commented in the press release following the publication of our findings: “The forthcoming economic statement will provide an opportunity to reassure the construction industry. Not only do we hope for more detail on the energy support package for businesses beyond the initial six month period, but additional clarity over the pipeline of projects. Recommitments on government spending will go a long way to boosting confidence.”

“An assured programme of projects from the public sector will drive growth and support jobs across the UK, with positive knock-on effects on private sector confidence, while delivering political ambitions around economic growth and jobs.”

Uncertainty

Our snap survey reveals a picture of economic uncertainty across the membership base and real fears over its impact on client confidence and the industry more broadly.

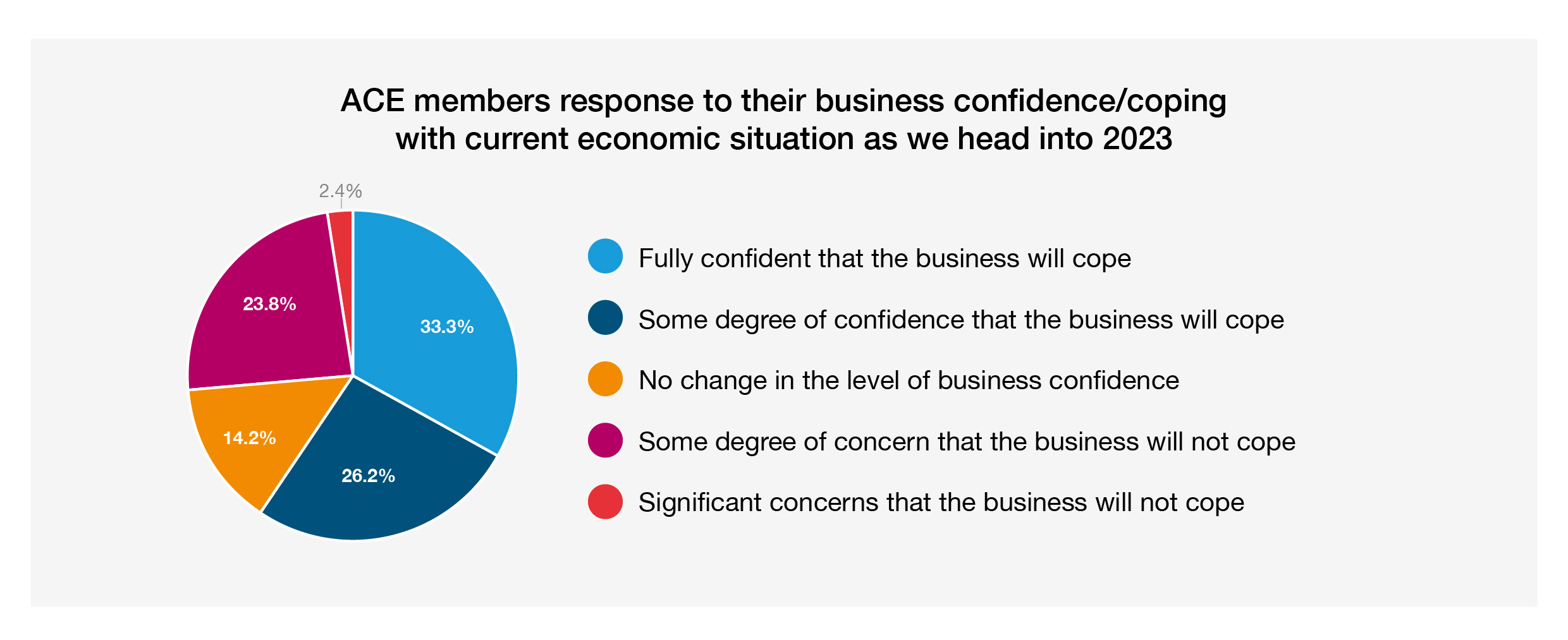

A third (33%) of businesses stated that they will be fully confident that they will be able to cope. Nearly 27% stated that they have some degree of confidence. However, a significant proportion, nearly a quarter (24%), of respondents stated that they have some degree of concern.

The uncertainty was also felt in views on the industry more widely towards the current crisis – half of respondents (50%) were unsure whether the construction industry will remain resilient and cope with the levels of uncertainty in the economy.

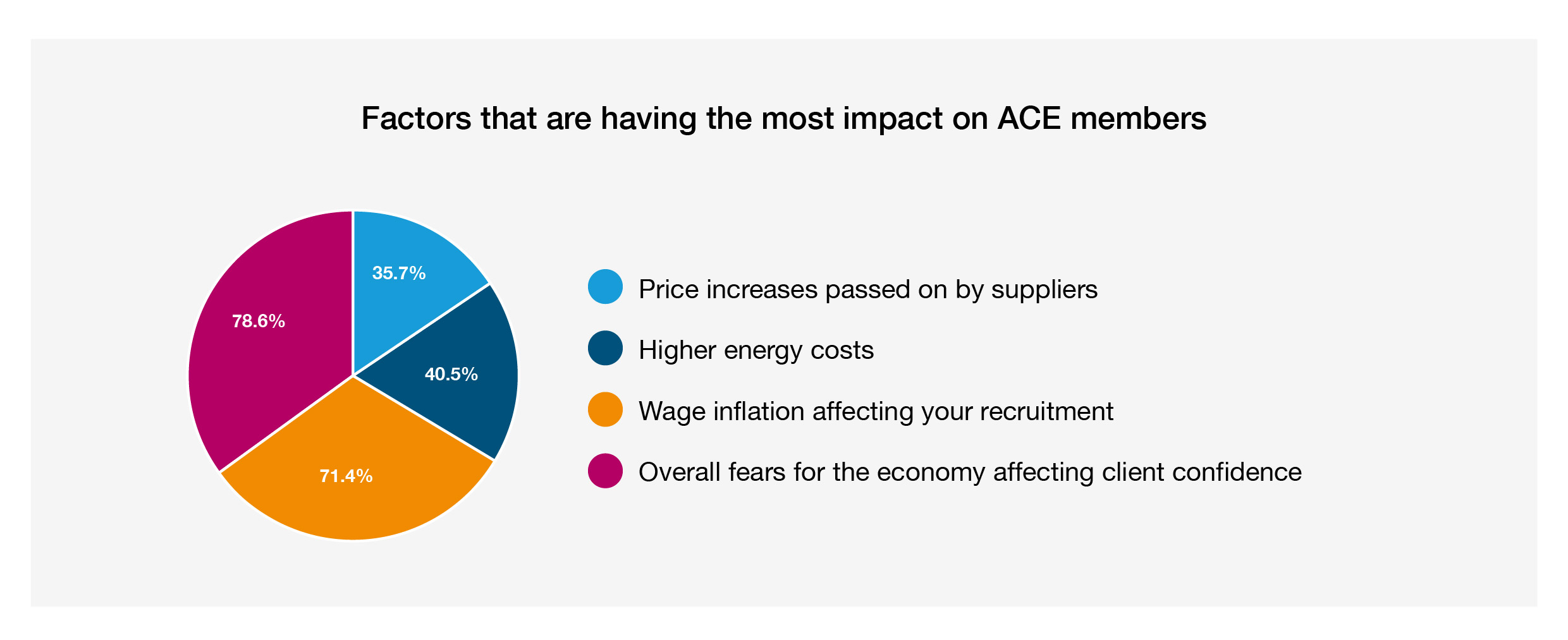

Members’ views on the impact this uncertainty was having showed fears over client confidence (79%) and wage inflation (71%), ahead of higher energy costs (40%) and price increases from suppliers (36%). Qualitative responses also reflected the challenging situation facing members: “It’s a very difficult period and we do need to change our approach to match our costs and fees. Unfortunately, fees are still being squeezed and this leads us to make difficult decisions.”

Our snap survey reveals a picture of economic uncertainty across the membership base and real fears over its impact on client confidence and the industry more broadly. Paul Barnes, policy researcher at ACE

Order books

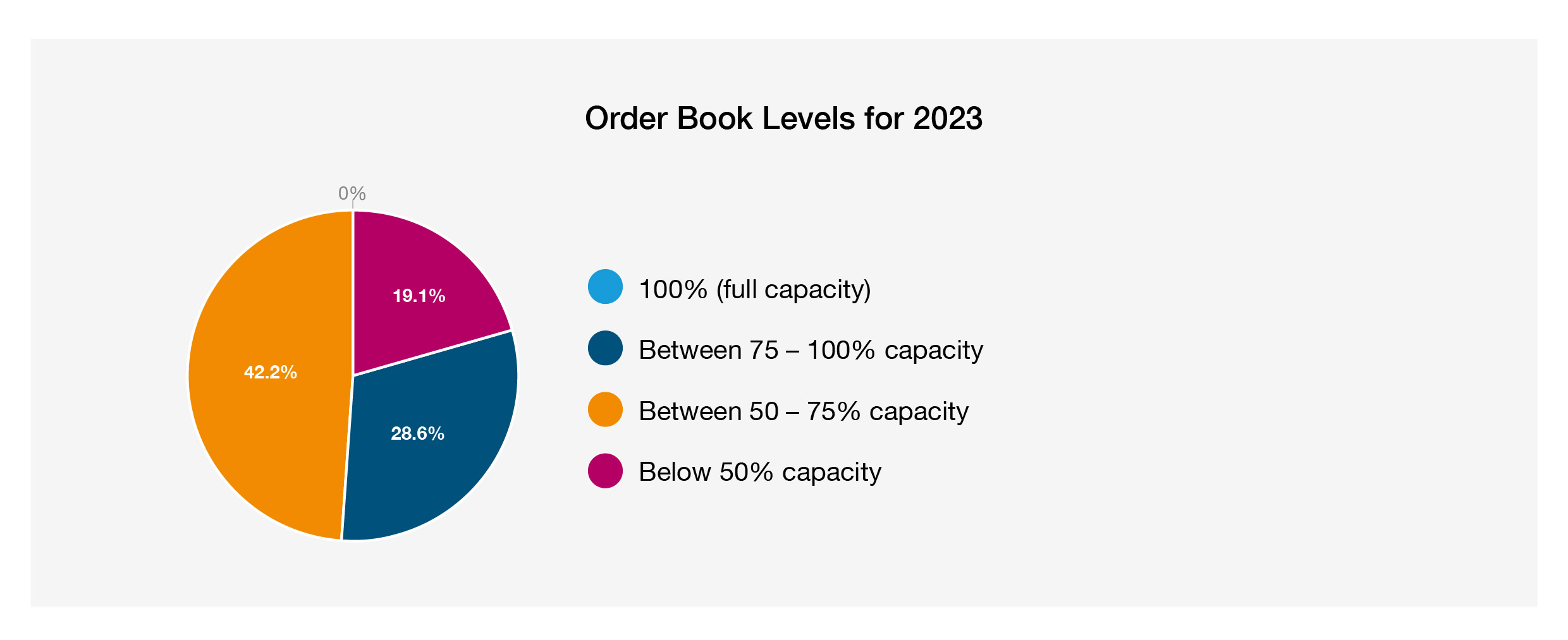

Order book levels for many ACE members presents an uncertain time ahead. Looking specifically at 2023, some members expressed the view that it was not possible to take more than a six months forward view.

With three months remaining in 2022, there is still plenty of unfilled capacity for the year ahead. No respondents were at full capacity.

As mentioned above, members have real fears over client confidence. This view will be supported by an increasing number of political and economic stakeholders (such as the Bank of England), painting a picture of overall business uncertainty and lack of confidence. There is a fear that they may withdraw from projects as we look towards the second half of 2023 and this may also be exacerbated by local councils pausing projects while they assess the impact of a new approach by the Government.

Energy

Overshadowed by subsequent events around the Queen a fortnight ago, ACE welcomed the outline to a package of energy support for business announced by Liz Truss in parliament. ACE is seeking additional clarity on how the scheme will work after the initial six month period.

Nearly 67% of respondents stated that the rising energy costs will have only a moderate effect on business confidence in 2023. But when asked if ACE members feel the construction sector is resilient enough to survive the current energy price increases, 57.1% stated that they were unsure that the sector would be resilient. For Large consultancies, the level of uncertainty was 45.5% and for SMEs this was even higher at 61.3%.

Once logged in, members can download the full member briefing on our survey results with more analysis and commentary.

Paul Barnes is policy researcher at ACE.